Are you Banking Online? Why not?

Banking analyst house Celent has published a new Retail Banking report called "Retail Internet Banking Vendors: Luring the Laggards."

Banking analyst house Celent has published a new Retail Banking report called "Retail Internet Banking Vendors: Luring the Laggards."

I thought it was funny they didn't say "Luring the Luddites." I bet there was a meeting about that.

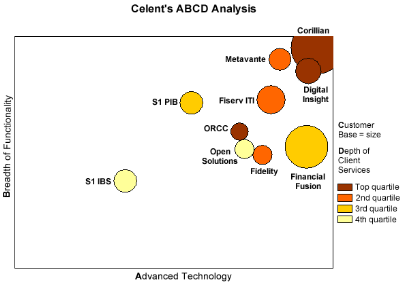

The company I work for, Corillian, is the big maroon dot in the upper right corner of the chart at right. Our arch nemesis (nemesi? Just kidding, they're lovely people), Digital Insight, is the smaller dot nipping at our dot. This is a multi-dimensional chart, with the size of the dot representing the size of our customer base, although I'm unclear if it's number of users, number of banks, or dollars the bank manages.

Across all four categories, Corillian stands out as the clear leader, followed by Digital Insight. Metavante, a low performer in Celent’s 2005 report, has significantly revamped its retail platform and has performed exceedingly well registering third overall. Online Resources, Fiserv, and S1 Personal Banking also received relatively strong grades.

As we often ask ourselves around here at Cori, who is not banking online and why?

Do you, Dear Reader, access your banking information online? If not, why not? (Especially considering that you're reading this blog!) Is it a hassle? Concerns about security? Where do you bank online and why? If you don't bank online, what would it take to get you banking and paying bills online? Do you want to pay bills from your phone? Discuss...

Follow up question: I personally haven't written a paper check in at least 5 years, possibly 10. If I could turn off checking all together (like ING Direct's Electric Checking) I'd do it. Who are these older ladies with their checkbooks slowing me down at the Grocery Store, and are you one of these ladies? ;) Seriously, do you write checks, and why?

About Scott

Scott Hanselman is a former professor, former Chief Architect in finance, now speaker, consultant, father, diabetic, and Microsoft employee. He is a failed stand-up comic, a cornrower, and a book author.

About Newsletter

Mike

If someone sends me a cheque, I usually return it and ask for direct payment. I think I've had one in the last 24 months and that was from the IRD (IRS).

If I need to talk to someone about a cardit card, loan etc, it's done over the phone or via email or their internal "mail" thing on the website.

It's fantastic. I'd not go back. I dont write cheques, everyting is done via electronic transfer etc. It's been this way for, um, 5+ years.

Welcome to New Zealand ;-) Even the banks WITH branches are like this, BTW.

Being able to manage my account online, and download that info into Quicken - I wouldn't want it any other way.

I developed quite a dislike for checks, although very fond of the money, the process of endorsing a check and then heading to the instant teller for a deposit is a pain, and something that I am likely to procrastinate on...

How about a person to person electronic transfer that doesn't include Pay Pal?

Yes... been banking "remotely" actually longer than Online. I live "not in Texas" yet that's where my "primarty" bank is. Intially it was all bank by mail/phone but eventually everything was made available online.

We pay most of our bills electronically... some via

manual Pull - going to the vendors website and making a payment which actually auths them to do a ACH withdrawal. This is generally our mortagage payment and credit cards.

automatic Pull - auto auth payments. Most of our bills are paid this way. Utiltities, Insurance, subscriptions, etc.

POS - we do 99% with Credit Cards. Don't use debit cards since I'd rather have the merchant pay the fee. Plus with credit cards you get alot of protection such as fraud protection, theft protection, purchase protection, etc all for free.

CHECKS - However, we still do write a few checks here and there. The guy that cuts the lawn, small donations to school/PTA, etc.

Cash - We usually have a small amount on hand, but use it very infrequently espesially since even places like McD's, Burger King, Subway have started taking credit cards.

Bottom line, I don't know why anyone would not bank online. Look at a place like everbank.com which has free checking, savings, you can have accounts in US$, Euro, Gold, Silver, they also do loans and have a brokerage. What a deal.

I do know I haven't physically walked into a bank, probably in over 15 years.!!! Been nice.

My grandma though, won't do it. She doesn't even have a PC. Actually she has "two" bank accounts, incase one fails. The bulk of her money is in a brokerage account that has check writing priveledges. So, there is still a good amount of the population that won't or can't bank online.

All my payments are made online.

One issue I've noticed (although it's getting better) is direct debit. In the UK it's common place. You buy a big item, you sign a couple of places and there's a direct debit set up from you to the supplier. Then you walk out the store. It seems much harder here in the US to do that.

From my UK bank account I can set up a direct deposit/debit online with a routing code and account number. That seems hard here also (although that may just be my banks).

As Michael mentioned (person to person/non paypal) - thats easy in the UK. Give your bank an account number and routing code and the money is moved. Trying to do that, at least with Wells Fargo is a pain in the butt. I can't do it online full stop.

Frankly banking in general in the US is pretty crap (personally). I've been told it's because historically Americans liked more control over their money (I guess a trust thing) so many people still walk into a branch to cash cheques, make payments etc. It just seems to be harder to do things electronically here. As Tim mentioned not everyone does online or direct debit payments and of those that do it's often complicated to set up.

This is turning into a rant.. Don't get me started about the differences in actual bank buildings (I often wonder why *every* bank in the US isn't robbed on a daily basis given the way they're set up).

Anyway, if you want some more coherent thoughts let me know and I'll sit and think so more.

One last thing though:

My main bank, Wells Fargo recently stopped the ability to see other accounts balances through their main page. That was a HUGE mistake in my opinion. It gave me a one stop shop for checking where I was at, and if they'd combined it with an easy ability to move funds around it would have been killer. I don't want an offline MS money type deal, I want one site where I can manage accounts, bills etc (stock/401 would be great but perhaps ott) in real time.

I don't know if they custom b-to-b'd each partner or if there are standard banking ws-* services around. If there are, and Corilian provided a consolidated view of all accounts supporting this I'd move to a bank running your platform in an instant.

Seriously. Banking isn't about checking 1 account with one branch of one bank anymore. The banks and financial institutions need to figure this out and make managing and moving money a whole lot easier.

It'd be great to consolidate everything at one bank but none fit the bill <s>...

I'd say the biggest hassle easily is the login procedures. Several banks and services have really complicated log on routines that can't be automated with password tool, so you end up fishing for passwords out of some password store.

Banking would hugely benefit for a common ID/logon system...

When I lived in Canada not five years ago, I didn't own a chequebook and I rarely even kept cash in my wallet. Now I have to write cheques for everything and I regularly carry $$ because I got tired of the exasperated sighs I'd get when I pulled out my credit card (assuming the place even took them).

If Corillian has any clout, I implore you to visit one or more banks down here and bring them, if not into the 21st century, at least into the late 90s.

You can't just tell the kid selling candles/wrapping paper/popcorn that you'll add them as a payee and they'll get your check in 5-7 days.

On the other side of it, processing fees are incredibly steep for one-time fund raisers. At our elementary school we try to provide it for the big-ticket events (auctions, write-a-check, etc) because the people want their mile bonuses, but find that we are paying the processor 10-20% of the proceeds!

Let's get those micropayment systems in place and universally accepted in the next five years or so, then you can drop-kick your checkbook into the shredder.

at that point of time, i remember that visa check card commercial where the guy paying with cash brings everything to a screeching halt. at that point i realized that commercials are nothing but nuggets of truth.

Z isn't in school yet is he... We write checks for preschool and elementary school stuff all the time. Field trips, supplies, fundraisers and script. Script is a fundraiser where grocers, home depot, starbucks and 100s more give out gift certs and cards for fundraisers for our schools. Basically we pay 100 for a 100 Fred Meyer card and Fred Meyer cuts a check for 1 - 7% to Portland Public or our preschool. Cash or check only and it is too provicial to send one through BofA or Onpointe. Plus our pizza place does cash or check and we never have cash so we write a check... Old school still is alive in NE Portland.

I was an early adopter of online banking and LOVE it. I would never have any idea of how much $$$ I had until I got online access. It gets better all the time.

Jack

One thing that pisses me off is the cost of wire transfers. Why do I still have to pay $10-$15 just to move my money from one pocket (er, account) to another? (Yes, I know that ING does it for free, but if I want a transfer between two accounts none of which is ING, I need to either do it through ING (twice as long), mail checks (yuck!) or pay up...

- Yard workers/day laborers (in AZ this is very popular) who you don't hire consistently. Get some guys who are in the neighborhood anyway to trim your thorny bushes and drag them away for you.

- My wife likes unique jewelry made by individuals. Those folks usually do all their own jewelry creation, staff their own events and do their own selling. To them it's usually cash or check.

- Cash-type gifts sent thru the mail (birthdays for nieces, nephews or young kids of family friends).

Sorry, had to vent there. But seriously, Scott, if you wrote hb.exe we need to talk.

Bill Pay with them is lame, and I would fully expect my power to be cut off if I started using it. I use PayTrust and love it, but again find download-to-quicken painful and not worth it.

ING is great, except I think the security is a bit overboard, especially since it breaks auto-download in Quicken (or any other tool). I'm hoping OpenID/CardSpace will help here eventually.

I use paper checks for payments to individuals- girl scout cookies, etc, but debit card and bill pay for everything else.

So, yes, I use online banking, but not without much pain due to usability and security.

On the other hand we have an interest-bearing checking account with ING and we positively hate the blasted thing. They seem to be struggling with their security model and they are always throwing up intrusive / annoying roadblocks to logging in. And they keep changing it. Unlike other financial institutions where you just have a username and PIN or password and it's easy to get in, ING can't seem to feel any confidence at all that you are who you claim to be. Ultimately that undermines my confidence in them, ironically.

That said ... some kind of biometric scanning would make me feel better about online banking / investing, while hopefully making it even easier to log in to various services. I don't know what the hold-up is on widespread use of fingerprint scanners -- standards I suppose.

Speaking of BoA, their online banking site is very impressive. I'm not sure who the eFinance provider is, but the experience is excellent, definitely the best I've seen anywhere. The My Portfolio view which aggregates data from all my credit, banking, broker, mortgage, 401(k), rewards, miles, utility bills, (even news feeds!) is a huge time saver, it blew me away the first time I tried it. I'm amazed at how interoperable it is, seemingly regardless of which institution my external account is with.

I only write a few checks - usually to laborers etc. and one for my cable bill (because it usually short term between moves). I could do that online but it'll take longer to do than write the single check and mail it. It's 2 minutes vs. 5 minutes to log on somewhere find enter or pick billing information etc. For a one off check it's faster to do manual. For more than one or two electronic makes sense.

Only time I write actual checks is when I go to Original Pancake House on Barbur for brunch as they only take cash or checks and for me writing them a check is a whole lot more convenient than having to go to an ATM for cash. Oh, and I also write checks sometimes to Valley Lanes for my bowling league payments.

All my bills are done through online billpay.

Most of the banks here in Portugal have very good online systems, and they see it has a big advantage. One example: my father, who is not very internet savvy, moved all his accounts to a new bank just because the web interface was easier to use.

Well, I have never seen the what Scott refers: "paying them (checks) online and letting your bank write the actual physical check", but it is so easy to transfer money to another bank account, you just need the number, and the banks only charge for it if is urgent (now).

#1. The laborers (e.g. the gardener, the guy who patched up holes in the wall, etc...) who have questionable status in US prefer to be under the radar and thus accept checks when you hand it to them, not mail it. If there was some Paypal-ish way (where the trust/privacy issues are addressed) to handle these payments that would be awesome.

#2. The integration in the electronic banking land is ok all there yet. For instance, I can't tell you how many times I got an email from the bank saying: The bill from Vendor (Verizon/Time Warner/Gas Company/whatever) was not received. Now WTF am I supposed to do with an email like this? The reason I am doing electronic banking, is that so that I don't have to deal with it. Maybe Scott can shed some light on why are these issues so common and what are possible solutions.

Regards

- My mother doesn't. She has an old computer with Windows 98. She uses it for reading emails, and surfing a little.

- My mother-in-law doesn't. She does not have an Internet access, though her computer (my sister-in-law's previous machine) is good enough for XP.

Conclusion: For those I know who don't do banking online, it's because it would be too expensive for them!

Writing checks: I write checks all the time for a simple reason. Not everybody accept online payments or credit cards. And even if some of them would accept some kind of online transaction, it's much simpler to pay people I meet in person the very moment I meet them.

I do also occasionally write checks: I'm buying a bed at Costco this week. Costco only takes cash, debit cards, American Express, and checks. Since I don't have an AmEx card, I'll have to dig out my checkbook and take it with me.

To answer your question as to why I still write a random check here and there, I guess it's because those rare payments are not made on a regular interval and they're made in person, so it's easier than having to remember to do it when I get home. (Someone needs to integrate one of those cell-phone based payment systems with a major bank's bill pay service, *hint* *hint* ...)

I do agree about the wife thing too. Not so much for me, but she wants control and doesn't feel she has it online. So she pays the bills with paper. She doesn't trust "the internet" for banking because it isn't reliable. Of course, we have comcast so it is down frequently. And since Onpoint is so bad, its hard to differenciate.

The reason I'm not doing "checks" online is that A) I didn't really know you could do that, B) I assume I would need the receiver's account number (or address? or just the name, and my bank would then write the check and mail it to me?) C) I have 250 or so checks sitting here in my desk drawer, and it's just as easy to write a check as it is to type one, D) a check is "instant" to the receiver -- how long does it take for a bank to write the check and do what they do (what do they do? mail it? to whom?).

I know I can look up the answers to those questions, but I figure letting you know my thought process would be more helpful.

I do everything else online.

If there wouldn't be things like a fruit market, I would not even need cash any more. Supermarkets accept CC or debit cards with PIN or signature. The PIN payment is faster than using cash.

This 'writing checks' all the time seems to be an american habit which I always found a bit strange.

I pay most of the monthly things by direct debit (here in Germany). Telephone, electricity, kindergarten etc. all direct debit. Some people may feel it's risky to let them just collect the money from your account, but actually it's not. There is a 'no questions asked' return policy. The bank will return the money immediately if you complain to them that the payment was not OK.

In fact some of the larger supermarkets have banned cheques and accept debit and cash only her in the UK.

Moving to the US from the UK 10 years ago was like stepping back in time. I'd been paying utility bills by direct debit since 1980 or earlier and phone banking (First Direct in the UK has been great!) since 1990. Moving to paying utility bills monthly (quarterly in the UK) by paper check and stamp was ... indescribable. I wondered why the bank wanted to ship us two boxes of checks when we opened accounts. Then we found out ...

Even now, as our children get older and I want to give them their allowances other than by cash, it's a joke. In the UK, I'd just set up a regular transfer to their accounts (which are at a different bank from mine because of ridiculous charges). Here in the US, sure I can set up a regular payment from my account ... and my bank cuts a check and mails it to them (at home!) and they then have to take it to their bank ATM. Crazy and must increase the cost of retail banking no end.

So ... is all that something that Corillian can hope to solve, or is the retail banking system in the US in need of fundamental overhaul? I'd hope for the former, but I'm not holding my breath - I think my children will be retired before it gets fixed!

And I only use cash to buy drinks at bars and t-shirts at rock concerts. Everything else goes on the card.

My parents do very little online banking. My mom is the lady in front of you at the store with the checkbook (though she's getting better about using the debit card). I don't think it's that they don't want to do it online, it just doesn't occur to them. "It's faster to just write the check and mail it." I think it's more a situation where they've always just paid their bills with checks so they have a certain comfort zone they aren't breaking out of. My dad uses TurboTax on the web every year to file his taxes... after he manually fills out the physical tax forms himself first.

I also think there are some UI usability issues for them - putting up an E*Trade style UI where there's every possible option you could ever want right there on the page in front of you is great for the experienced user who knows exactly what they're doing and where they want to go, but newcomers and less technically literate folks need something a lot simpler than that. My parents don't need 15 different pivot tables and 150 "creative" ways in which to display their finances; they just need to learn how to pay a bill online first. Seeing the sheer quantity of information is confusing and intimidating to them (though they'll never admit it) so they just avoid the whole issue by paying with a check.

Don't these retailers watch the CC comercials that tell you to use you CC rather than write a check cause you need 3 forms of ID to write a check?

Argh!

BOb

All I can say is, welcome to the 21st Century! I mean, really, what is the point? I still reckon that the main reason that people pay by cheque (<- note correct spelling.. ;-) is to flaunt the inefficiencies of the banks, in that they can pay by cheque about 5 days before they get paid, safe in the knowledge that by the time it clears the funds will be there.

Finally, I can stop being behind the only person in the entire supermarket that is paying using this out-dated mode of payment.

Hopefully, the demise of paper banking and the rise of electronic banking will also mean an end to the high-street bank, which of course will make way for many more trendy wine bars....

Also, barring Western Union, cheques are probably the least secure way to pay. In the UK, you can wait 5 days for the cheque to clear at the bank while they do all the necessary checks etc., but they can still yank the cash out of your account any time in the future that they find the transaction to be invalid.

Arggh! I hate banks, lol!

magazine subscriptions/renewals, certain medical bills, and certain insurance bills I have all require you to mail in the stub

I usually just enter my credit card number for magazine subscriptions - they usually include a spot for that...medical bills and insurance bills, I've actually found as long as you include your account number, I've never lost an e-payment. They are mailed a check with the account number printed in the memo field and they'll apply it happily. They really do want our money...

Why can't I have an electronic check that I can print out, that the other person can pay into there bank account on line provided the name of the account matches?

A recurring theme in these comments seems to be "I can't pay someone online, because they aren't setup to receive online payments, etc".

Any decent online bill payment service will let you send a payment to anyone with an address. If they accept electronic payments, they will get one. If they don't, they will get a paper check in the mail.

@ bob archer -- they ask for ID to prevent someone from using your CC fraudulently. My wife had her purse stolen, and within an hour they'd charged up hundreds of dollars' worth of merchandise. A simple ID check would have stopped that; now someone (CC company or merchant) gets to eat that cost. (Not us, thank goodness.) I'm happy when people ask for ID for CC transactions.

Very useful when you have to spend a couple months out of the country. :-)

My reasons are that I like the physical self documentation of a check. A number of times over the years I have had a vendor (like my Mortgage company) accept a cancelled check image as proof of payment but they would not accept an emailed transaction register.

Since I write software for a living, I know that at times "things" happen to data and to the best programs that were not intended. And since I have worked at 2 major banks as a programmer, I know exactly how unperfect they are.

The best argument I can give is the same one that I use for not having the laser eye surgery. When eye doctors start having it done in droves then I will. Both my opticians still wear glasses. And almost all the management I was involved with at both banks still write checks!

One manager in particular said that if checks ever go away, then currency won't be to far behind, and that would be very very bad in my mind. Considering it can take weeks of leg work to convince a bank they have made a mistake. It would be worse if you had only the banks data to rely on to make your case when money "evaporates" from your account for some reason.

I do make online purchases with a credit card, and I use very little cash, mostly my debit card, but I always ask for a receipt, and I always print the order page out when I order online.

Frankly I look at paper checks as a kind of check and balance, no pun intended. For the same reasons I am seriously upset at electronic voting machines. Anyone with sufficient resources could tamper with those systems and there would be no physical ballots to fall back on. Sure recounts are a mess, who could ever forget when we all learned what a "chad" was. But the outcry would have been worse had there been no ballots to count.

I am not afraid of technology, I am just familiar enough with it to know it can be much more easily manipulated, than actual hardcopy paper. With the paper you need physical access, with data any kid with a connection can potentially mess with your life!

Cheers,

Bob Porter

In other words, of the banks on your customer list: http://www.corillian.com/customers/, which are the best?

- School expenses. Most of my checkbook register entries are for all of the little things we're asked to pay for at our kids' school. Books, sports fees, field trips, etc.

- Family & friends balance of trade. Next to school expenses, there's a flow of reimbursements between family and friends for grocery runs and other items they pick up or order on our behalf.

- Miscellaneous donations, Girl Scout cookies, etc. While some forms allow me to provide a credit card number, I'm wary of doing so for privacy reasons.

I'm sure these all could go away with the right replacements. For example, I'd love to be able to do the exchanges by credit card or PayPal so I could automatically track them with the rest of the budget. I see two problems blocking that today: the recipients don't bother or don't know how to set themselves up for electronic payments, and while I could have Checkfree send a check, I'd rather not have to set up payees for each of them in online banking.

It would be great to have some frictionless form of payment that's secure, requires zero per-transaction/per-payee setup (I don't mind one-time setup) and can be done in person, online or by phone.

One thing to keep in mind: Those people who have checking accounts earning high interest rates are better off paying some large bills by paper check instead of by using online bill pay. Here is the reason:

When you pay a bill online, whether the money is sent by ACH transfer or if the bank sends a check for you, the money gets deducted from your account the day you ask the payment to be sent. If the money is sent by ACH transfer, the payee will likely see the bill within two days and will credit you with the payment at that time. If the bank cuts the check for you, the payee will credit you with the payment only when the payee sees the check.

When you send a check to a payee, you receive the credit for the payment as soon as the payee sees the check. However, the money does not get deducted from your account until the payee deposits or cashes the check. Between the time the payee sees the check and the money is deposited, you are earning interest on the check amount! This interest won't be huge, but can outweigh the costs of writing a paper check (envelope, stamp, time, etc.).

The time between receiving a check and having it deposited varies from payee to payee. But I have established a rule of thumb for what types of payments I should send by paper check. If you have an interest earning checking account, you can establish your own ROT as well.

Comments are closed.